|

MUDRA, which stands for Micro Units Development & Refinance Agency Ltd., is a new institution being set up by Government of India for development and refinancing activities relating to micro units. It was announced by the Hon’ble Finance Minister while presenting the Union Budget for FY 2016. The purpose of MUDRA is to provide funding to the non corporate small business sector.

As per Department of Financial Services, Ministry of Finance, Govt. of India’s letter No.27/01/2015-CP/RRB dated May 14, 2015 loans given to non-farm income generating enterprises in manufacturing, trading and services whose credit needs are below Rs.10 lakh by all the Public Sector Banks, Regional Rural Banks, State Cooperative Banks and Urban Co-operative Banks will be known as MUDRA loans under the Pradhan Mantri MUDRA Yojana (PMMY). All such loans can be covered under refinance and/or credit enhancement products of MUDRA.

In addition to these Banks, NBFCs and MFIs operating across the country can also extend credit to this segment, for which they can avail financial assistance from MUDRA Ltd., subject to their conforming to the approved eligibility criteria. Eligibility criteria for availing refinance/financial assistance by institutions from MUDRA has been finalized and hosted at MUDRA’s website.

To begin with, based on eligibility criteria, MUDRA has enrolled 27 Public Sector Banks, 17 Private Sector Banks, 27 Regional Rural Banks and 25 Micro Finance Institutions (as per the below listed table) as partner institutions for channelizing assistance to the ultimate borrower.

List of MFIs shortlisted (Tentative) |

S.No. |

Bank Name |

Place in which Registered Office is situated |

1 |

S V Creditline Pvt. Ltd. |

Gurgaon. |

2 |

Margdarshak Financial Services Ltd. |

Lucknow. |

3 |

Madura Micro Finance Ltd. |

Chennai. |

4 |

ESAF Micro Finance & Investments P. Ltd. |

Thrissur, Kerala. |

5 |

Fusion Micro Finance P. Ltd. |

New Delhi. |

6 |

Ujjivan Financial Services P. Ltd. |

Bangalore. |

7 |

Future Financial Services Ltd. |

Chitoor, Andhra Pradesh. |

8 |

SKS Microfinance Ltd. |

Hyderabad. |

9 |

Utkarsh Micro Finance P. Ltd. |

Varanasi |

10 |

Equitas Micro Finance Pvt. Ltd. |

Chennai. |

11 |

Sonata Finance Pvt. Ltd. |

Allahabad. |

12 |

Saija Finance Private Ltd. |

Patna. |

13 |

Arth Micro Finance Pvt. Ltd. |

Jaipur, Rajasthan. |

14 |

Shikhar Microfinance Pvt. Ltd. |

Dwaraka, New Delhi. |

15 |

Navachetana Microfin Services Pvt. Ltd. |

Haveri, Karnataka. |

16 |

Samasta Microfinance Ltd. |

Bangalore. |

17 |

Satin Credit Care Network Ltd. |

Delhi. |

18 |

Sahyog Microfinance Ltd. |

Bhopal. |

19 |

Arohan Financial Services P. Ltd. |

Kolkata. |

20 |

Cashpor Micro Credit |

Varanasi |

21 |

Digamber Capfin Ltd. |

Jaipur |

22 |

Bhartiya Micro Credit |

Lucknow. |

23 |

Sakhi Samudaya Kosh |

Solapur. |

24 |

Midland Microfin Ltd. |

Jalandar. |

25 |

RGVN (North East) Microfinance Ltd. |

Guwahati. |

MUDRA VISION

"To be an integrated financial and support services provider par excellence benchmarked with global best practices and standards for the bottom of the pyramid universe for their comprehensive economic and social development."

MUDRA MISSION

"To create an inclusive, sustainable and value based entrepreneurial culture, in collaboration with our partner institutions in achieving economic success and financial security."

MUDRA PURPOSE

Our basic purpose is to attain development in an inclusive and sustainable manner by supporting and promoting partner Institutions and creating an ecosystem of growth for micro enterprises sector.

MUDRA ROLES AND RESPONSIBILITIES

- MUDRA would primarily be responsible for:

- Laying down policy guidelines for micro enterprise financing business

- Registration of MFI entities

- Supervision of MFI entities

- Accreditation /rating of MFI entities

- Laying down responsible financing practices to ward off over indebtedness and ensure proper client protection principles and methods of recovery

- Development of standardized set of covenants governing last mile lending to micro enterprises

- Promoting right technology solutions for the last mile

- Formulating and running a Credit Guarantee scheme for providing guarantees to the loans/portfolios which are being extended to micro enterprises

- Supporting development & promotional activities in the sector

- Creating a good architecture of Last Mile Credit Delivery to micro businesses under the scheme of Pradhan Mantri MUDRA Yojana

Process flow Diagram

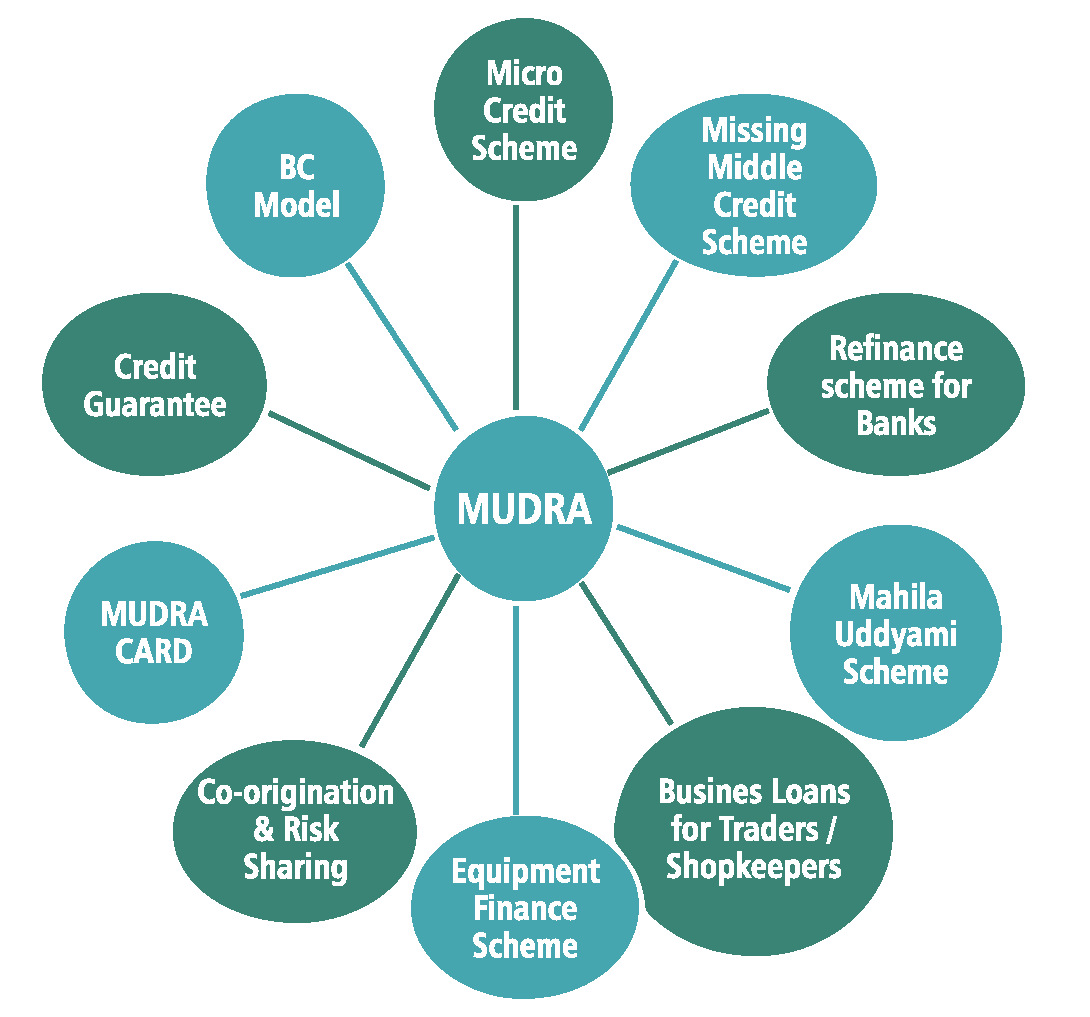

Product/Offerings of MUDRA

- To start-with, MUDRA will need two categories of products; viz; refinance product for the micro units having loan requirement in the range of Rs. 50,000/- to Rs. 10 lakh and support to MFIs for on-lending etc. MUDRA will be providing refinance to micro business under the Scheme of Pradhan Mantri MUDRA Yojana. The other products are for development support to the sector. The bouquet of offerings of MUDRA is depicted below. The offerings would be targeted across the spectrum of beneficiary segments.

- Under the aegis of Pradhan Mantri MUDRA Yojana, MUDRA has already created its initial products / schemes. The interventions have been named 'Shishu', 'Kishor' and 'Tarun' to signify the stage of growth / development and funding needs of the beneficiary micro unit / entrepreneur and also provide a reference point for the next phase of graduation / growth to look forward to:

Shishu: covering loans up to Rs. 50,000/-

Kishor: covering loans above Rs. 50,000/-

Tarun: covering loans above Rs. 5 lakh and up to Rs. 10 lakh

It would be ensured that at least 60% of the credit goes to Shishu Category Units and the balance to Kishor and Tarun Categories.

- Within the framework and overall objective of development and growth of Shishu, Kishor and Tarun units, the products being offered by MUDRA at the rollout stage have been designed to meet requirements of different sectors / business activities as well as business / entrepreneur segments. Brief particulars are as under:

- Sector/activity specific schemes.

- Micro Credit Scheme (MCS).

- Refinance Scheme for Regional Rural Banks (RRBs) / Scheduled Co-operative Banks.

- Mahila Uddyami Scheme.

- Business Loan for Traders & Shopkeepers.

- Missing Middle Credit Scheme.

- Equipment Finance for Micro Units.

The salient features of the schemes and innovative products, being worked upon, which will be offered by MUDRA going forward, are as below:

- Sector/Activity Focussed Schemes

To maximize coverage of beneficiaries and tailor products to meet requirements of specific business activities, sector / activity focused schemes would be rolled out. To begin with, based on higher concentration of businesses in certain activities/sectors, schemes are being proposed for:

Land Transport Sector / Activity; which will inter alia support units for purchase of transport vehicles for goods and personal transport such as auto rickshaw, small goods transport vehicle, 3 wheelers, e-rickshaw, passenger cars, taxis, etc.

- Community, Social & Personal Service Activities such as saloons, beauty parlours, gymnasium, boutiques, tailoring shops, dry cleaning, cycle and motorcycle repair shop, DTP and Photocopying Facilities, Medicine Shops, Courier Agents, etc.

- Food Products Sector; support would be available for undertaking activities such as papad making, achaar making, jam / jelly making, agricultural produce preservation at rural level, sweet shops, small service food stalls and day to day catering / canteen services, cold chain vehicles, cold storages, ice making units, ice cream making units, biscuit, bread and bun making, etc.

- Textile Products Sector / Activity, to provide support for undertaking activities such as handloom, powerloom, chikan work, zari and zardozi work, traditional embroidery and hand work, traditional dyeing and printing, apparel design, knitting, cotton ginning, computerized embroidery, stitching and other textile non garment products such as bags, vehicle accessories, furnishing accessories, etc.

Going forward, schemes would similarly be added for other sectors / activities as well.

Financial support to MFIs for on lending to Individuals/ groups of individuals /JLGs/ SHGs for creation of qualifying assets as per RBI guidelines towards setting up / running micro enterprises as per MSMED Act and non-farm income generating activities.

- Missing Middle Credit Scheme

Financial support to financial Intermediaries for on-lending to individuals for setting up / running micro enterprises as per MSMED Act and nonfarm income generating activities with beneficiary loan size of Rs. 50,000/- to Rs. 10 lakh per enterprise /borrower.

- Refinance Scheme for RRBs / Co-operative Banks

Enhancing liquidity of RRBs / Scheduled Co-operative Banks by refinancing loan extended to micro enterprises as per MSMED Act with beneficiary loan size up to Rs.10 lakh per enterprise / borrower for manufacturing and service sector enterprises.

Timely and adequate financial support to the MFIs, for on lending to women / group of women / JLGs/ SHGs for creation of qualifying assets as per RBI guidelines towards setting up / running micro enterprises as per MSMED Act and non-farm income generating activities.

- Business loans for Traders and Shopkeepers

Timely and adequate financial support for on lending to individuals for running their shops / trading & business activities / service enterprises and non-farm income generating activities with beneficiary loan size of up to Rs. 10 lakh per enterprise / borrower.

- Equipment Finance Scheme for Micro Units

Timely and adequate financial support for on lending to individuals for setting up micro enterprises by purchasing necessary machinery / equipments with per beneficiary loan size of up to Rs. 10 lakh.

- Products for the Transport Sector

Refinance for innovative products in the Small Road Transport Sector whereby constraints such as lack of capital requirements of the micro unit for meeting margin money for asset acquisition is met by the financing NBFC/MFI.

Innovative Offerings

MUDRA Card

- Going forward, MUDRA would look at improving the offerings basket by looking at innovative ideas like a pre-loaded MUDRA Card, say with an assessed value.

- The credit limit available on MUDRA Card could be 20% of the loan limit sanctioned to the enterprise, with a maximum credit limit on the card being 10,000/-. The principal issuer will be MUDRA and credit risk of up to 20% of the card portfolio could also be covered under the Credit Guarantee Scheme of MUDRA. The remaining risk would remain with the MFI partners.

- The card offering will help provide pre-approved credit line to the members by providing a card that can be utilized to purchase raw materials and components, from registered producers on an online platform.

- The card could be linked with Pradhan Mantri Jan Dhan Yojana Savings Account of the borrower and the drawals could also be enabled through the Bank’s ATM network for meeting the immediate liquidity problems of the micro enterprise.

Portfolio Credit Guarantee

- Traditional financing in Indian context adopts an Asset Based lending approach with emphasis on collaterals. Micro units, most of the times, are unable to provide the comfort of collaterals.

- To mitigate the issue of collaterals, MUDRA will be offering a Credit Guarantee Product.

- Further, given the context of the industry / segment, since the individual loan sizes would expectedly be small and number of loans will be large, the option of a Portfolio Guarantee Product will be explored. Under this option, Credit Guarantee or Risk Sharing would be provided for a portfolio of homogenous loans instead of a Scheme for individual loan - by - loan guarantee. This is expected to create administrative efficiencies and increase receptiveness for the Credit Guarantee product. The Guarantee product would be one of the key interventions proposed with the objective of bringing down the cost of funds for the end beneficiary to improve its creditworthiness.

- Further, the time has come when there is a need to move away from the asset based lending approach to other innovative approaches, say Business Idea funding Approach or cash flow based lending schemes, where there may not be underlying tangible primary assets. The comfort of primary lenders for lending to such segment would increase if credit guarantee instrument is available.

Creation of Resources for Credit Enhancement / Guarantee Facility

The corpus proposed for the Credit Guarantee Scheme would be regularly augmented with a charge on the outstanding loans under refinance. The same would be utilized for providing first loss guarantee / credit enhancement for securitized portfolio loans, as discussed below4.

Credit enhancement:

Facilities offered to cover probable losses from a pool of securitized assets in the form of credit risk cover through a letter of credit, guarantee or other assurance from the originator / co-originator or a third party to enhance investment grade in any securitization process. First loss facility is the first level of credit enhancement offered as part of the process in bringing the securities to investment grade. Second loss facility provides the second / subsequent tier of protection against potential losses.

Underwriting for Intermediaries

As MUDRA evolves, it will have to look for newer innovative offerings based on the cardinal principle of 'problem solving.' It is necessary that the intermediaries and last mile financiers which have the real expertise in funding the NCSB sector have access to a steady flow of long term debt capital at a reasonable cost to smoothly continue their onlending activities as also scale up sustainably. As of now, these intermediaries face significant difficulties in raising debt. There is also a need to widen the investor / lender base for such intermediaries.

Securitization would be a useful tool for such long term capital flow. However, as the market for securitization deals from the asset class of NCSB is nascent, it would first need to be nurtured and developed. MUDRA proposes to step in through interventions such as:

Providing credit enhancements: Credit enhancements by way of first loss guarantee / collateral would be provided by MUDRA for securitization pools from the NCSBS asset class to be originated by MFIs and other intermediaries. MUDRA’s support to such transactions will facilitate improvement in credit rating of such asset pools and hence securitization deal flow in the sector.

Adopting Co/ Multiple Originator Models: There would be a need to bring about cost and administrative efficiencies in securitization transactions. Further, as the loan sizes are small, many smaller intermediaries may not be able to provide by themselves a threshold size of assets for securitization. To address such issues, the multiple originator model would be encouraged whereby asset pools of more than one originator / intermediary could be bundled for securitization.

MUDRA will build on experiences of some of the existing players who have demonstrated ability to cater to the NCSB segment. Models developed in the industry would be looked at for adaptation. Being an apex agency with whom intermediaries would be registered / availing refinance from, MUDRA would be well placed to play an effective role in helping crystallize such securitization deals under multiple originator models.

Similar other interventions for market making and creation of the right ecosystem would be taken up by MUDRA.

Business / Banking Correspondent Model

To capitalize on expertise in lending and collections [which is often segment / region specific] developed by intermediaries / last mile financiers in the small / informal business segment as also to meet their capital requirements, a product for lending through the Business / Banking Correspondent Model is envisaged.

MUDRA Offerings- Addressing the Non-Credit Gaps

Besides the credit constraints, the NCSBs face many non-credit challenges, like,

- Skill Development Gaps

- Knowledge Gaps

- Information Asymmetry

- Financial Literacy

- Lack of growth orientation

To address these constraints, MUDRA will have to adopt a credit- plus approach and offer Developmental and Support services to the target audience. It will have to act as a market maker and build –up an ecosystem with capacities to deliver value in an efficient and sustainable manner.

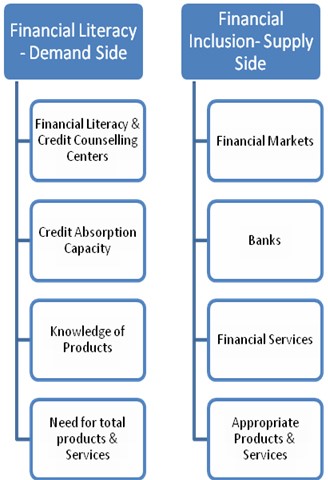

Supporting Financial Literacy

Financial literacy or financial education can broadly be defined as 'providing familiarity with and understanding of financial market products, especially rewards and risks, in order making informed choices.'

Financial Inclusion and Financial Literacy are twin pillars. While Financial Inclusion acts from supply side providing the financial market / services that people demand, Financial Literacy stimulates the demand side – making people aware of what they can demand. Supporting the financial literacy drive will contribute substantially from the demand side to the national agenda of financial inclusion.

Promotion and Support of Grass Root Institutions

One of the major focus areas will be to formalize and institutionalize the last mile financiers / grass root institutions so that a new category of financial institutions viz. Small Business Finance Companies can be created and ecosystem developed for their growth.

Rural innovations at micro enterprise / unit level would also be one of the key areas for intervention and support. Support to Micro units by way of the facility of incubators would be taken up. This would ensure that at the most grass root levels in the country, there is climate for promotion of innovation as well as incubation of ideas from educated rural youths which would germinate in viable micro enterprises.

Creation of Framework for "Small Business Finance Entities"

An enabling framework for support to "Small Business Finance Entities" would be created leading to formalization of the economy which is presently included in the informal sector.

Synergies with National Rural Livelihoods Mission

NRLM implementation is in a Mission Mode. This enables (a) shift from the present allocation based strategy to a demand driven strategy enabling the States to formulate their own livelihoods-based poverty reduction action plans, (b) focus on targets, outcomes and time bound delivery, (c) continuous capacity building, imparting requisite skills and creating linkages with livelihood opportunities for the poor, including those emerging in the organized sector, and (d) monitoring against targets of poverty outcomes. As NRLM follows a demand driven strategy, the States have the flexibility to develop their livelihoods-based perspective plans and annual action plans for poverty reduction. The overall plans would be within the allocation for the State based on inter-se poverty ratios.

NRLM Mission: "To reduce poverty by enabling the poor households to access gainful self-employment and skilled wage employment opportunities, resulting in appreciable improvement in their livelihoods on a sustainable basis, through building strong grassroots institutions of the poor."

Efforts would be made to draw synergies between NRLM and MUDRA interventions for greater public good.

Working with Credit Bureaus

With the growth of responsible lending practices, Credit Bureaus (CB) have gained increasing level of acceptability in the micro finance sector. The CB culture will help in creating credit history over a period of time which will facilitate faster credit dispensation as the system evolves.

Working with Rating Agencies

Accreditation / rating of MFI entities is one of the roles earmarked for MUDRA. Further, a segment of financial intermediaries for the non corporate small business sector is envisaged to emerge in the financing architecture. MUDRA would work in coordination with Rating Agencies so that appropriate rating framework(s) which take into account sector specific features are devised for various sector participants. In the longer run, availability of rating for sector participants would facilitate formalization and further flow of capital to the sector.

The MUDRA Pricing

Access to finance is critical and equally critical is the cost of finance to the NCSB/ultimate beneficiary. The funds mobilized by micro units from the informal sources are at high cost. There is scope for cost rationalization. However, the rationalization is intricately linked with the cost of funds for the last mile MFIs.

The NBFC-MFIs are presently regulated by Reserve Bank of India and RBI has already prescribed detailed guidelines for margin cap in respect of MFIs. The margin cap has been pegged at 10% for MFIs having loan portfolio of more than 100 crore and 12% for smaller MFIs having loan portfolio of less than 100 crore. In the backdrop of these guidelines and the fact that MFI sector has been constantly trying to reduce its costs, MUDRA would also help MFIs reduce their cost to bring down the overall cost to the end beneficiaries. Further, at the time of appraisal, MUDRA would be studying / assessing individual MFIs on this as well as other related parameters and suitably price its assistance based on such assessment.

Working on the premise that the cost to the ultimate beneficiary should be reasonable and affordable, the cost of funds of MUDRA should be 150 bps to 200 bps below the benchmark repo rates. This seems to be very much feasible as GoI is willing to support MUDRA in mobilizing low cost funds through refinance support from RBI/multilateral institutions. MUDRA will have to adopt a cost plus approach for pricing its offerings.

MUDRA will thus be a refinancing agency which will need funding below market rates through State interventions which in turn will help it channelize the assistance to the last mile financiers as well as the ultimate beneficiary micro units at reasonable rates. Access to finance in conjunction with rational price is going to be the unique customer value proposition of MUDRA.

The MUDRA Processes

MUDRA's delivery channel is conceived to be through the route of refinance primarily to NBFCs / MFIs, besides other intermediaries including banks, Primary Lending Institutions, etc.

At the same time, there is a need to develop and expand the delivery channel at the ground level. In this context, there is already in existence, a large number of "Last Mile Financiers" in the form of companies, trusts, societies, associations, etc. which are providing informal finance to small businesses.

Consultation with stakeholders has brought about a need to formalize and leverage upon this informal delivery channel which exists on the ground and has competence in lending as well as collections from the target segment.

The financing architecture conceptualized for the MUDRA Bank would thus also be aimed towards integration of these "last mile financiers" into the formal delivery channel by utilizing intermediaries such as NBFCs / NBFC – MFIs as also Non Corporate MFIs.

There is also a need to identify the financiers that are operating in small towns and cities of India meeting the local credit needs. Efforts are to be made to build up their capacities so that over a passage of time, they are able to grow their size, expand their area of operations as well as bring down their costs of funds.

This would enable them to upscale their lending capabilities to this sector as well as reduce cost of funds. Thus, one of the key issues before MUDRA would be to bring them in its financial architecture and recognize the rightful role that they have been playing in provision of credit in local markets for a long time.

Further, one of the key approaches of MUDRA should be to rekindle entrepreneurship by nurturing institutions in the financial sector which would provide easy and innovative access of credit to deserving entrepreneurs without any complex formalities attached.

The above would be in the nature of a multi-tier arrangement / intermediation and evolving a suitable delivery architecture for this route including requirements such as system of registration of the last mile financiers, inculcating responsible lending and collection practices amongst them, maintaining efficiencies in cost of delivery at different tiers / levels and development of a standardized set of covenants governing last mile lending would be taken up.

While the intermediaries to be refinanced by MUDRA Bank would initially be the existing NBFCs / MFIs, in the longer run, with the segment becoming formalized and therefore likely to attract more capital, the channel is expected to result in creation of an enabling ecosystem for a new type of financial intermediary called "Small Business Finance Companies" which would specialize in this segment.

Technology leveraging will form the backbone of the delivery system to be put in place by MUDRA in association with the intermediaries. For the last mile delivery, Mobile Technology holds immense potential.

Technology Platform: An appropriate platform would have to be put in place for promoting right technology solutions for the last mile. System which is enabled for the following would be needed:

- Registration of non formal entities

- Linkages for uploading of beneficiary data by MFI / intermediaries to MUDRA Bank and capturing data relating to credit flow and beneficiary details such as area, type of activity, seasonality, types of product, community etc.

- Facility for inputs from Business / Banking Correspondents

- Facility for linkages to :

- the UID / Aadhaar database / system

- the Pradhan Mantri Jan-Dhan Yojana Bank Accounts.

- Credit Bureaus

- Entities such as Mix Market

- Technology flow to informal sector

MUDRA : Supervision of the Segment Partners

The Corporate Micro Finance Sector is regulated by Reserve Bank of India at present. The other micro finance players are registered entities such as Trusts, Societies, Co-operative Societies, etc.

All institutions expecting to partner with MUDRA for refinance will have to be registered with MUDRA.

If such Registered Entities of MUDRA are not regulated by any existing Regulator, MUDRA will prescribe set of regulatory covenants for them. The provisions for regulation as envisaged for MUDRA will flow in due course of time upon Statutory Enactment for the creation of MUDRA.

The definition of micro unit for the purposes of MUDRA's activities should not be linked with MSME or any other Act. For the purpose of units covered under MUDRA, micro units may be termed as proprietorship / partnership firms running as small manufacturing units, shopkeepers, fruits/vegetable sellers, hair cutting saloon, beauty parlours, transporters, truck operators, hawkers, co-operatives or body of individuals, food service units, repair shops, machine operators, small industries, artisans, food processors, self help groups, professionals and service providers etc. in rural and urban areas with financing requirements of less than 10 lakh.

MUDRA Strategic Focus

Product – Innovative

Pricing – Lower than Prevailing

Processes – Efficient

Specialization – Micro

Scale – India Unincorporated

Sustainability – of Stakeholders

Technology – The Game Changer

Looking Forward

The establishment of MUDRA would not only help in increasing access of finance to the unbanked but also bring down the cost of finance from the Last Mile Financiers to the micro/small enterprises, most of which are in the informal sector.

Further, the approach goes beyond credit only approach and offers a credit – plus solution for these myriad micro enterprises spread across the country. In sum, the key characteristics of MUDRA are depicted in the figure given below.

MUDRA : The Indian Way

|